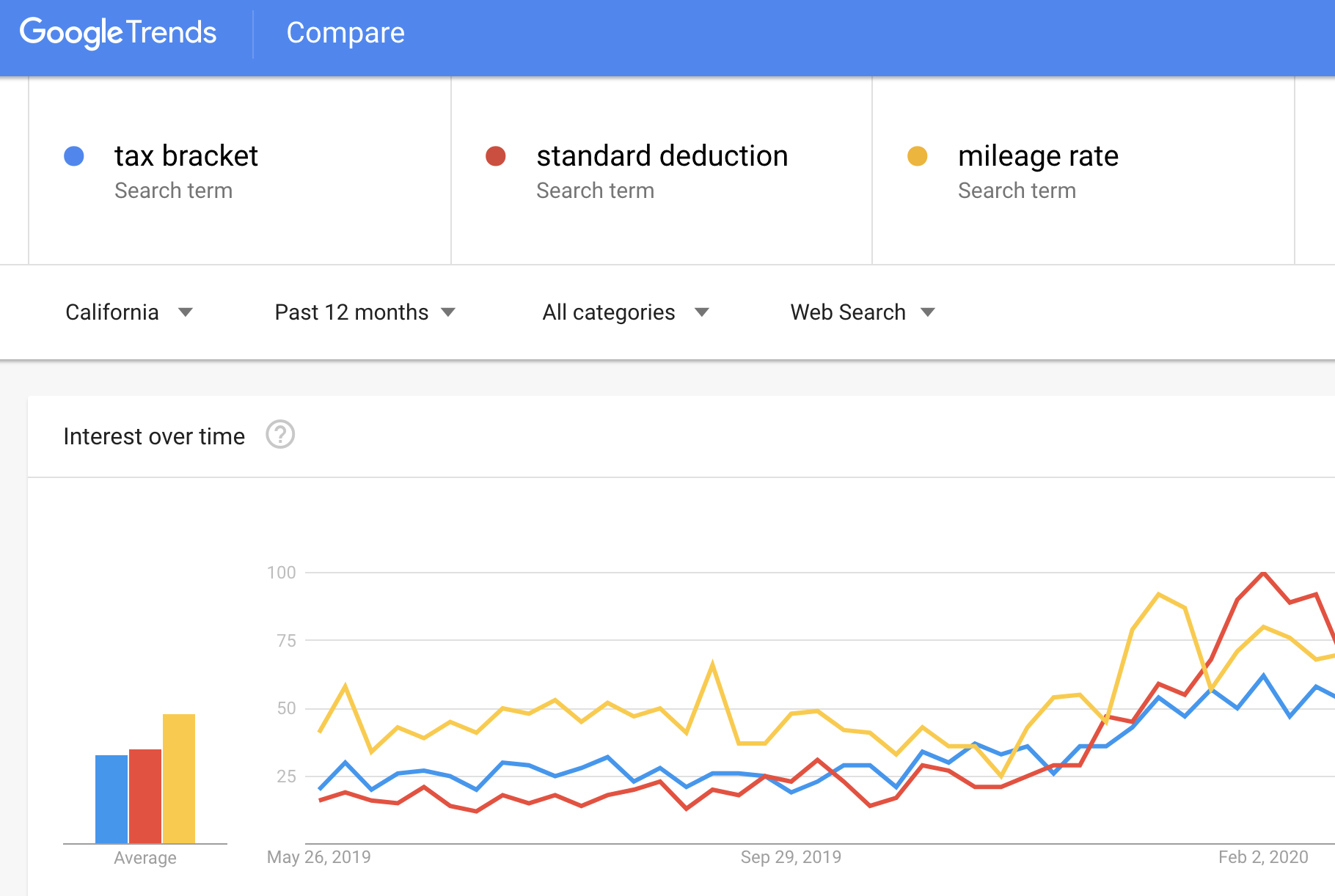

According to Google Trends, around January each year, we start to see a sharp spike in tax-related searches as April 15th approaches. This type of information is insightful because our goal is to continually find ways to support our clients and make the process of filing taxes and financial planning a straightforward and enjoyable experience.

Taking a closer look, we found three common topics that are consistently searched throughout the year and wanted to provide some quick information for your reference.

____________________

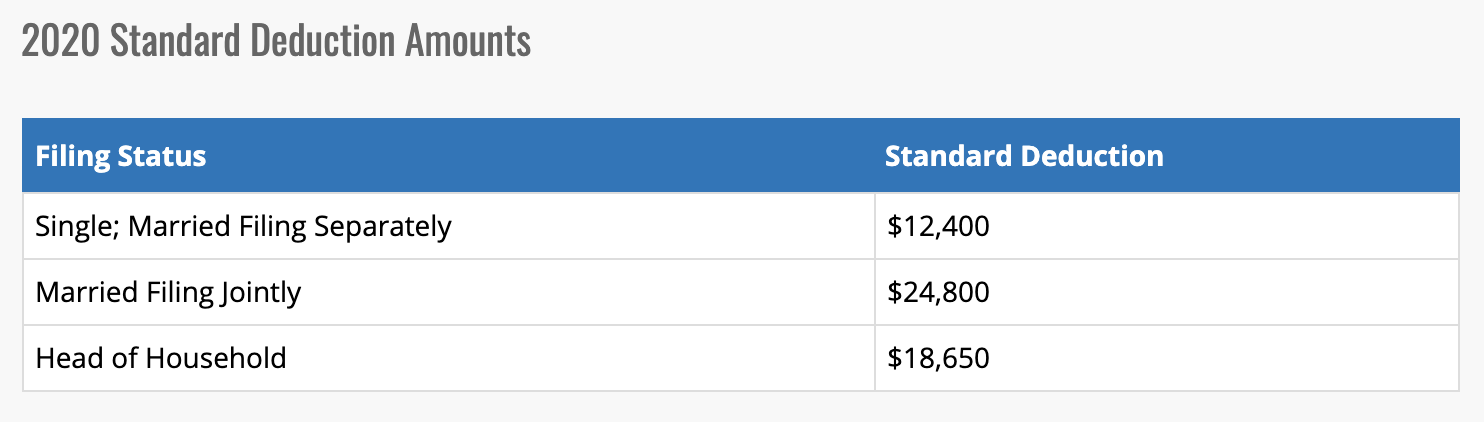

QUESTION: What is the standard deduction in 2020?

Taxpayers have two options when it comes to deductions. You can either take the standard deduction, even if you have no other qualifying tax credits or itemize your deductions.

If you decide to take the standard deduction, you reduce your taxable income by a specified dollar amount. In 2020, the standard deduction increased slightly to the amounts shown below.

Source: Kiplinger

____________________

QUESTION: What is the mileage reimbursement rate in California?

We are currently living through unprecedented times where a large portion of business travel has been canceled or postponed. We’ve replaced meetings that we may have traveled to, with video conferences from our homes. According to Statista and before the stay-at-home order, Americans were taking over 470 million business trips per year!

So, it is no surprise that one topic that is consistently searched on Google throughout the year is the mileage rate for reimbursement.

The cost per mile is designated by state law and as of January 2020 is,

- 5 cents per mile driven for business use (in 2019, the rate was 58 cents per mile)

- 17 cents per mile driven for medical or moving purposes (previously 20 cents per mile)

- 14 cents per mile driven in service of charitable organizations.

The IRS bases the mileage rate on national averages and reassesses them annually.

____________________

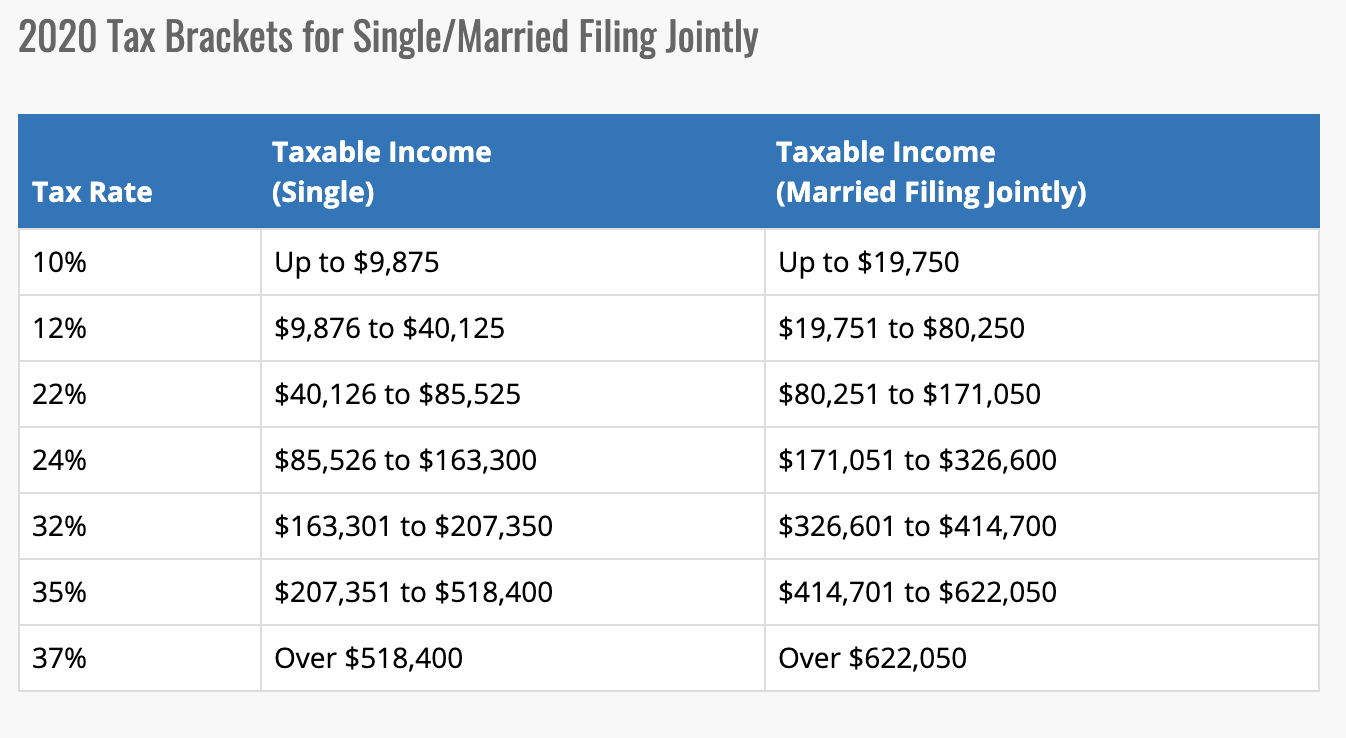

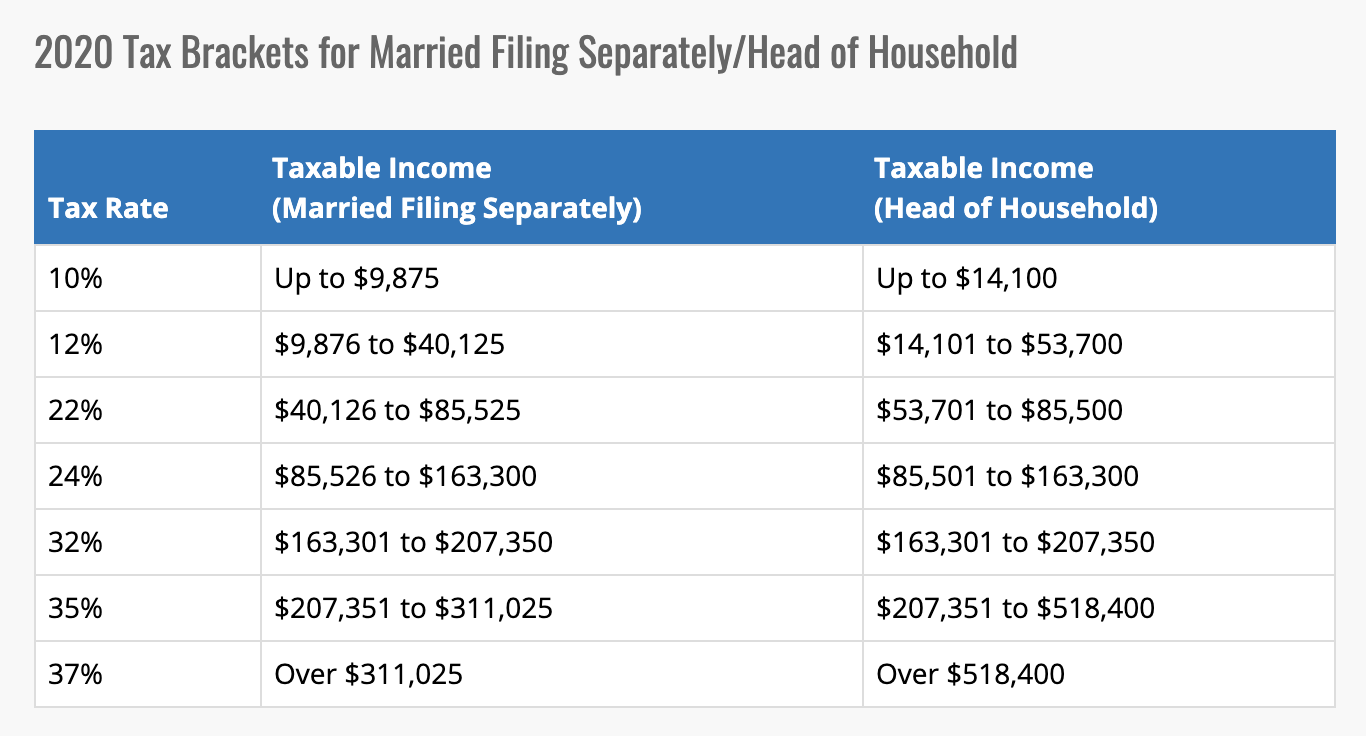

QUESTION: What tax bracket am I in?

Another commonly searched topic is tax brackets: how they work and how to determine your tax rate.

There are seven federal income tax brackets, and the system is progressive, which means that different tax rates will apply to different portions of your income, and they only apply to your taxable income (total income minus all adjustments and deductions).

The 2020 tax brackets below apply to how much you should pay during the year 2020 when you file in 2021.

.

Source: Kiplinger